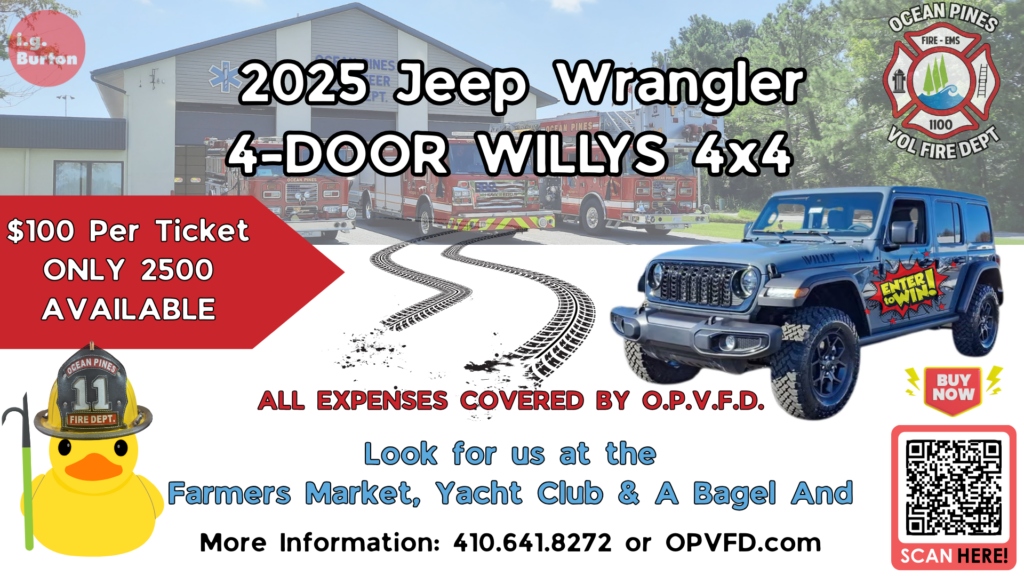

***Just like 2024, the Ocean Pines Volunteer Fire Department will pay the MVA title, registration fees and sales tax along with the gaming taxes claimed by the winner. The winner will still claim the winnings off the value of the vehicle and receive a necessary tax forms for the year 2025.

2025 Jeep Wrangler Raffle Rules

- Must be 18 or older to purchase raffle ticket.

- Ticket holders do not have to be present to win.

- The winner will be notified immediately following the drawing.

Just like in 2024, the Ocean Pines Volunteer Fire Department will pay the MVA title, registration fees and sales tax along with the gaming taxes claimed by the winner.

The winner will still claim the winnings off the value of the Ford F-150 and receive a W2G form for the year 2024. (see below) Value of $54,045.00. - The winner is responsible for claiming all applicable federal and state gaming taxes.

- State Gaming Information

Who must pay Maryland income taxes on their winnings?

Anyone who receives winnings from lottery games, racetrack betting or gambling must pay income tax on the prize money. Both residents and nonresidents of Maryland are subject to Maryland income tax on their winnings. - Federal Gaming Information

A tax-exempt organization (OPVFD) sponsoring a gaming event (2023 Explorer Raffle) must file Form W-2G when an individual wins a prize over a specific value amount. The form is used to report gambling winnings or to report both gambling winnings and any federal income tax withheld on the winnings.

A noncash payment, such as a car, must be evaluated at its fair market value for purposes of reporting and withholding. If, after deducting the price of the wager, the fair market value exceeds $5,000, the winnings are subject to 28% regular gambling withholding.

When does the tax-exempt organization (OPVFD) file the Forms W-2G? The tax- exempt organization organizing the gaming event must furnish each winner meeting the filing requirement a Form W-2G by January 31. In addition, it must send Copy A of the W-2G, along with Form 1096, to the IRS by the last day of February. See the instructions on Form 1096, Annual Summary of U.S. Information Returns, for additional information regarding submission of the W-2G to the IRS.

- State Gaming Information

- If the winner wishes not to be responsible for claiming any of the federal, state and vehicle taxes. The winner can choose to withdrawal from such winnings. At which another drawing will occur, and ticket holder will be notified.